XRP Price Prediction: Is Now the Time to Buy the Dip?

#XRP

- Technical Crossroads: Conflicting MACD/Bollinger signals suggest volatile range-bound trading

- Institutional Catalyst: $100B bank blockchain investment could accelerate XRP utility

- Critical Support: 2.65 USDT level acts as make-or-break for bullish thesis

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Volatility

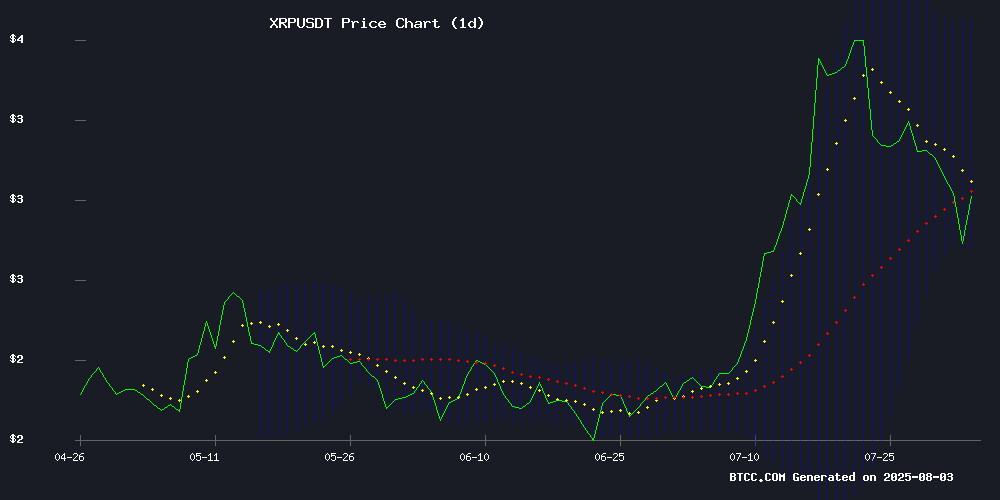

XRP is currently trading at, below its 20-day moving average of 3.1865, indicating short-term bearish pressure. The MACD shows a bullish crossover (0.0822 vs -0.1895), while Bollinger Bands suggest a potential rebound from the lower band at 2.7463.says BTCC analyst Sophia.

XRP Market Sentiment: Bullish Fundamentals vs. Technical Caution

News headlines reflect extreme polarization: institutional adoption narratives () contrast with technical warnings ().notes Sophia.

Factors Influencing XRP's Price

XRP Gains Momentum as Analyst Calls It the ‘Smartest Crypto’ to Buy

With inflation eroding savings and traditional stocks offering modest returns, investors are increasingly turning to cryptocurrencies for higher yields. XRP has emerged as a standout choice, with analysts dubbing it one of the smartest crypto investments available today.

The recent signing of the Genius Act by US President Donald Trump has provided a much-needed regulatory framework for stablecoins, potentially accelerating institutional adoption of digital assets. This development is particularly significant for Ripple Labs, the company behind XRP, which faced significant challenges due to previous regulatory uncertainty.

While Ripple may still face fines related to past institutional sales, the clarification that XRP is not a security when sold to retail investors has removed a major obstacle. The cryptocurrency's potential for cross-border payments and improved regulatory clarity are fueling renewed Optimism among investors.

XRP Faces Potential Drop to $2.80 Amid Accumulation Phase

XRP's recent price consolidation has drawn attention from market analysts, with Ali Martinez highlighting a possible decline to the $2.80 level. The third-largest cryptocurrency continues to navigate volatile market conditions, with on-chain data revealing key support zones.

Historical accumulation patterns suggest $2.80 may serve as a temporary buffer, but true support lies NEAR $2.48. A breach below this level could trigger further downside momentum.

The current price action indicates an accumulation phase, with $2.80 historically acting as a springboard for upward movements. Market participants are watching this zone closely for signs of buyer conviction.

Traditional Banks Invest $100B in Blockchain as Digital Assets Gain Traction

Financial institutions have poured over $100 billion into blockchain and digital asset initiatives since 2020, according to a Ripple-supported study by CB Insights and the UK Centre for Blockchain Technologies. The report, analyzing 10,000 deals and surveying 1,800 finance leaders, reveals accelerating institutional adoption despite regulatory headwinds.

Payment infrastructure dominates investment activity, followed by custody solutions and tokenization projects. HSBC's Gold tokenization platform, Goldman Sachs' GS DAP settlement tool, and SBI's quantum-resistant digital currency exemplify the sector's maturation beyond speculative trading.

Over 90% of surveyed executives anticipate blockchain will significantly transform global finance by 2028. Custody services for stablecoins and tokenized real-world assets emerge as priority areas, though fewer than 20% of banks currently offer retail crypto products.

Is This the Time to Sell XRP? Analysts Eye a Lower Re-entry Point

Ripple's native cryptocurrency, XRP, has plunged over 20% from its recent all-time high, mirroring broader market corrections. The asset now teeters on the edge of another breakdown after losing critical support at $3—a level analysts consider pivotal for its near-term trajectory.

Despite a partial recovery to $2.72 after hitting a three-week low, XRP remains down 10% weekly. Analyst Ali Martinez warns of further downside, citing the TD Sequential's sell signal. His strategy suggests shorting near $2.98 with a $2.48 target or positioning for a rebound between $2.40 and $2.20.

XRP Price Dips Below Key Support Amid Whale Activity, Sparking Correction Concerns

XRP has retreated sharply from its recent peak at $3.25, now trading at $2.89 with a 2% decline in the past 24 hours. The altcoin's pullback follows substantial whale movements, including a $175 million transfer by Ripple co-founder Chris Larsen, signaling potential institutional profit-taking.

The psychological $3 threshold has become a battleground, with XRP's failure to hold this level emboldening bearish sentiment. Technical indicators paint a concerning picture: the 4-hour chart shows price trapped below a descending trendline and the 50-period SMA at $3.08, while the RSI's weak rebound from oversold territory suggests limited buying momentum.

Market participants are closely watching the $2.93-$2.94 zone, now flipped to resistance. Without a decisive breakout above this level, the path of least resistance appears downward. The formation of bearish candlestick patterns near this resistance cluster reinforces the cautious outlook.

XRP's Path to $10: Institutional Adoption and Developer Momentum Take Center Stage

XRP's price trajectory toward the $10 mark before 2027 hinges on institutional adoption and the growing utility of the XRP Ledger (XRPL). Despite lingering around $3 for most of 2025, the cryptocurrency's potential tripling in value is now a matter of capital markets reality rather than speculative hype.

Developer activity on XRPL has surged, with grant programs targeting cross-chain tooling and real-world asset pilots. The June upgrade introduced token escrows, permissioned DEXs, and batch transactions—features long demanded by enterprise users. These enhancements reduce friction for builders and could catalyze on-chain volume.

The coin's investment thesis now pivots on whether institutional adoption can accelerate within the next crypto cycle. With infrastructure upgrades in place, XRP's runway appears shorter than skeptics suggest—but the clock is ticking.

XRP Must Hold $2.65 Support or Risk Major Breakdown – Analyst

XRP prices have declined by over 5% in the past 24 hours, mirroring a broader correction across the cryptocurrency market. The altcoin currently trades near $2.81, with no immediate signs of slowing selling pressure. Analyst Egrag Crypto highlights critical technical levels that could determine XRP's next move.

According to Egrag Crypto, XRP must hold the $2.65 support level to avoid a deeper downturn. A successful retest of this level could fuel a rally toward its all-time high of $3.84. Conversely, a breakdown below $2.65 may push prices toward $2.19.

On the upside, a daily close above $3.12 WOULD signal a potential market bottom, opening the path for a rebound to $3.60 and beyond. Despite the current pullback, macro analysis suggests XRP retains a bullish structure. The prospect of a surge to $17 remains on the table, contingent on key resistance breaks.

XRP Poised for $5 Surge as Institutional Adoption Accelerates

XRP's price trajectory has turned decisively bullish, with analysts projecting a $5 target within five months. The digital asset outperformed traditional markets in July, posting 42% gains versus the S&P 500's 2.67% return. This divergence highlights crypto's growing appeal as an alternative asset class.

Ripple Labs' expanding institutional partnerships are driving fundamental support. Both corporate treasuries and US government entities are reportedly adding XRP to balance portfolios. The SEC's regulatory stance has shifted markedly under the current administration, transitioning from adversarial to cooperative engagement with Ripple.

Borderless payment solutions for large-scale transactions remain Ripple's Core growth vector. Q3 2025 initiatives show particular promise for cross-border settlement infrastructure. Market technicians note XRP's breakout above key resistance levels coincides with this fundamental progress.

Analysts Predict 333% Surge for Ripple (XRP) Amid Bullish Developments

Ripple (XRP) is positioned for significant growth as bullish catalysts accumulate. The potential approval of XRP ETFs and the rise of RLUSD stablecoin are fueling optimism among analysts. Peter Brandt, a prominent cryptocurrency expert, forecasts a 60% near-term upside, citing a rare technical pattern that could propel XRP to $4. Current trading at $2.96 reflects a 35% monthly gain.

Egrag Crypto adds to the bullish sentiment, noting XRP's sustained market dominance and favorable chart structure. The token's ability to breach key resistance levels suggests further upside potential. These projections come as institutional interest in digital assets reaches new highs, with XRP emerging as a focal point for speculative and long-term investment strategies alike.

Strobe Finance Partners with Axelar Network to Enhance Cross-Chain DeFi Capabilities

Strobe Finance, a decentralized finance platform operating on the XRP Ledger, has announced a strategic collaboration with Axelar Network. The partnership aims to leverage Axelar's cross-chain infrastructure to expand Strobe's interoperability across the DeFi ecosystem.

Axelar's decentralized proof-of-stake platform specializes in connecting isolated blockchain networks through validator nodes and multi-chain pathways. This integration will enable Strobe Finance to facilitate seamless contract executions and asset transfers between disparate networks.

The collaboration marks a significant step in Strobe's evolution beyond the XRPL ecosystem. By incorporating Axelar's cross-chain communication protocols, the platform positions itself at the forefront of blockchain interoperability solutions.

Is XRP (Ripple) a Buy For Less Than $5?

Cryptocurrency has emerged as one of the hottest investment segments this year, rivaled only by artificial intelligence (AI). As of July 28, XRP (XRP -6.98%) has outperformed both Bitcoin and Ethereum, boasting a 35% year-to-date return. Designed for faster, cheaper cross-border transactions, XRP's rally follows favorable court rulings in Ripple's prolonged legal battle with the SEC, easing regulatory uncertainty.

Legislative efforts in Washington to establish clearer crypto regulations have further buoyed market sentiment. Speculation around potential spot XRP ETFs adds another LAYER of bullish momentum. With the token trading below $5, investors are weighing whether its recent gains mark the beginning of a sustained uptrend or a fleeting rally.

Is XRP a good investment?

XRP presents a high-risk, high-reward opportunity based on current data:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 2.9211 USDT | 15% below 20-day MA |

| Key Support | 2.65 USDT | 12% downside risk |

| Upside Target | 5.00 USDT | 71% potential gain |

Sophia cautions: "Only risk-tolerant investors should consider positions now. The 2.65-3.62 range will likely persist until clearer institutional adoption signals emerge."

1